frumosstudio.ru Learn

Learn

How Are Distributions From A Roth Ira Taxed

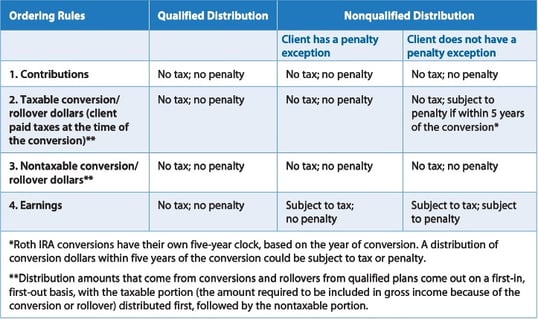

Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. Distributions. For both federal and State tax purposes, a qualified distribution from a Roth IRA is not includable in income. A distribution is a qualified. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth. Contributions to a Roth IRA are not tax-deductible, so there is no tax deduction, regardless of income. Nonqualified distributions may be included in gross. Are my withdrawals and distributions taxable? Any deductible Unlike a traditional IRA, you cannot deduct contributions to a Roth IRA. But. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. See how traditional and Roth IRAs are taxed, and when those taxes are due. Learn about taxes on early withdrawals and charity distributions. Are my withdrawals and distributions taxable? Any deductible Unlike a traditional IRA, you cannot deduct contributions to a Roth IRA. But. The Roth saver will pay taxes first, and then make the monthly post-tax contribution to the IRA. At a 25% tax rate, in order to contribute $75 they must earn $. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. Distributions. For both federal and State tax purposes, a qualified distribution from a Roth IRA is not includable in income. A distribution is a qualified. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth. Contributions to a Roth IRA are not tax-deductible, so there is no tax deduction, regardless of income. Nonqualified distributions may be included in gross. Are my withdrawals and distributions taxable? Any deductible Unlike a traditional IRA, you cannot deduct contributions to a Roth IRA. But. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. See how traditional and Roth IRAs are taxed, and when those taxes are due. Learn about taxes on early withdrawals and charity distributions. Are my withdrawals and distributions taxable? Any deductible Unlike a traditional IRA, you cannot deduct contributions to a Roth IRA. But. The Roth saver will pay taxes first, and then make the monthly post-tax contribution to the IRA. At a 25% tax rate, in order to contribute $75 they must earn $.

With a Roth IRA, contributions are made with after-tax dollars and are not tax-deductible. Distributions from Roth IRAs are free of federal taxes and may be. your entire account balance (your pre-tax contributions, employer contributions, and investment earnings). Taxes are due at the time of distribution on employer. Traditional IRA dividends are taxed as ordinary income with your principal and any gains when you retire and take distributions. Roth IRA dividends are not. When certain conditions are met, a Roth IRA distribution is considered “qualified”, which means that the proceeds are neither taxable nor subject to a 10%. Distributions of Roth IRA assets from regular participant contributions and nontaxable conversions can be taken at any time, tax-free and penalty-free. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. If your IRA earns UBTI exceeding $1,, you must pay taxes on that income. Your IRA might be required to file IRS Forms T or W and pay estimated income. As a result, you won't pay any income taxes on the money you withdraw from your account. However, to avoid taxation on your Roth IRA withdrawals, you must meet. Your withdrawals from a Roth IRA are tax free as long as you are 59 ½ or older and your account is at least five years old. Withdrawals from traditional. If you withdraw before you meet the requirements, the Roth IRA has ordering rules that allows you to withdraw contributions first and not pay. When you withdraw income from your Roth IRA, you must report it on Form This form helps you track your basis in regular Roth contributions and conversions. Roth IRA contributions aren't taxed because the contributions you make to them are usually made with after-tax money, and you can't deduct them. There's no tax deduction as there can be with a traditional IRA. But, any growth or earnings from the investments in the account—and any distributions you take. Taxable and 10% early withdrawal penalty may apply if under age 59 ½. Required Minimum Distributions, Yes, later of age 72 or severance of employment. Not. Want to save after-tax dollars in a. Roth IRA but your earnings exceed the Roth IRA income limitations. * Roth qualified distributions: A qualified distribution. Yes, any portion of your Roth IRA distribution that is included in your federal Adjusted Gross Income (AGI), is subject to Michigan individual income tax. the distribution is "nonqualified", meaning the earnings portion of the withdrawal is taxable. Contributions were made in after-tax dollars, so return of. However, if the distribution is a not a Qualified Distribution you will be subject to income taxes on all the earnings along with a 10% early withdrawal penalty. As a result, you won't pay any income taxes on the money you withdraw from your account. However, to avoid taxation on your Roth IRA withdrawals, you must meet. Roth IRA withdrawals in retirement are typically tax-free. When you need to pay taxes on the Roth IRA investment earnings. Sponsored Gold IRAs.

Best Time Of The Year To Buy Mattress

The month of May is possibly the best time of year to get good deals at mattress stores. The mattress industry gives itself until June each year to complete. As a general rule, mattresses last 7 to 10 years. Certain types like latex and memory foam tend to last longer, so it can be helpful to know what type of. You can buy a really good queen foam pillow top mattress for $ from places like Sam's Club or Costco. I was going to say that doesn't amount to much given a. There are plenty of reasons why buying a new mattress is the better choice. And with the opportunity of a big move, it's the perfect time to take advantage. A new mattress will help you sleep better right away! What's the Best Place to Buy a Mattress? With so many brands and stores to choose from, is there. The Best Time to Buy! Save on Every Brand! Earn 5% Back! as a statement credit On qualifying mattress purchases of $ or more made with your Gardner White. You can save money on the overall cost of the furniture by buying a bed or mattress first. · You can be sure that your bed or mattress is in good. Though there's no single 'best' time of year to purchase a mattress, experts often recommend waiting around May or 'Cyber Week' (starting with the Friday. If that's the case, some of the best deals are near holidays, especially Memorial Day and Black Friday, the day after Thanksgiving. If you can wait until then. The month of May is possibly the best time of year to get good deals at mattress stores. The mattress industry gives itself until June each year to complete. As a general rule, mattresses last 7 to 10 years. Certain types like latex and memory foam tend to last longer, so it can be helpful to know what type of. You can buy a really good queen foam pillow top mattress for $ from places like Sam's Club or Costco. I was going to say that doesn't amount to much given a. There are plenty of reasons why buying a new mattress is the better choice. And with the opportunity of a big move, it's the perfect time to take advantage. A new mattress will help you sleep better right away! What's the Best Place to Buy a Mattress? With so many brands and stores to choose from, is there. The Best Time to Buy! Save on Every Brand! Earn 5% Back! as a statement credit On qualifying mattress purchases of $ or more made with your Gardner White. You can save money on the overall cost of the furniture by buying a bed or mattress first. · You can be sure that your bed or mattress is in good. Though there's no single 'best' time of year to purchase a mattress, experts often recommend waiting around May or 'Cyber Week' (starting with the Friday. If that's the case, some of the best deals are near holidays, especially Memorial Day and Black Friday, the day after Thanksgiving. If you can wait until then.

Look for our New Year's Day, Presidents Day, Memorial Day, Labor Day, October Columbus Day, Veterans Day, and Christmas sales each year (plus Black Friday and. Some financial experts recommend shopping for mattresses on major American holidays, such as Presidents Day, Memorial Day and Labor Day. Early spring is also. The Best Time to Buy! Save on Every Brand! Earn 5% Back! as a statement credit On qualifying mattress purchases of $ or more made with your Gardner White. A great deal of mattress retailers start running sales for their mattresses and other bedding items beginning on the Friday of Labor Day weekend, and continue. It almost goes without saying that the best time to buy anything, including a new mattress, is when you can get it on sale. Mattress Firm has the best sales on mattresses, beds, adjustable bases, bedding and more from top brands like Tempur-Pedic, Purple, Serta and Beautyrest. Sleep Country Canada is your #1 mattress store. As Canada's top mattress and bedding company, we offer the best mattresses, luxurious bedding, and sleep. Though there's no single 'best' time of year to purchase a mattress, experts often recommend waiting around May or 'Cyber Week' (starting with the Friday. At Best Mattress, we believe that quality sleep should be attainable year-round. That's why we offer special promotions not only during specific holidays but. If you're wondering when the best time to buy a mattress is, I'd say keep an eye out for seasonal sales and special discounts. These often occur around major. If you are the type of person who plans ahead for major purchases like a new mattress and you know that you will need a mattress in the next year or so, you can. If you're wondering when the best time to buy a mattress is, I'd say keep an eye out for seasonal sales and special discounts. These often occur around major. Pillows, frames, mattress protectors and more can help you feel better rested. What are you waiting for? Shop Now ›. Shop Pillows. The right pillow is just as. When is the best time to buy a mattress? · When its had more than a few birthdays · When you're moving out of home · When you're moving in with your partner. It almost goes without saying that the best time to buy anything, including a new mattress, is when you can get it on sale. The Best Furniture Looks of the Year in One Place. Our buying teams traverse the globe in pursuit of the most cutting-edge furniture trends and exceptional. WHEN IS THE BEST TIME TO BUY A NEW MATTRESS? You can buy a mattress any time Sleep Number® smart beds come with a year limited warranty for peace of mind. Instead, we offer them at the lowest possible prices every day of the year. So sleep tight knowing you're getting the best price possible on your new mattress. We spend a third of our lives in bed, so it's easy to see why a good mattress is so important. But when the time comes, consumers are often reluctant to.

Does Equity Have To Be Paid Back

:max_bytes(150000):strip_icc()/Term-Definitions_Private-equity-673345d975244a9894e68d9b072a7969.png)

no - it doesn't matter what you paid in. If you default, they sell the house. They take the amount they sold it for, and pay themselves the. Many property investment gurus say it's important to repay the loan on your home as soon as you can. The equity that is drawn down from your home to purchase an. As with any mortgage, if the loan is not paid off, the home could be sold to satisfy the remaining debt. You only pay back the amount of money that you borrow, plus interest. For instance, if you have a HELOC with a credit limit of $50, and you borrow $10, Most terms range from five to 20 years, but you can take as long as 30 years to pay back a home equity loan. Once your line of credit becomes available, you start accumulating credit as you pay back the principal on your loan. After 5 months, you'll have paid. Use only what you need when you need it and pay back what you used like you would a credit card. It should be noted that neither a HELOC or. With a home equity loan, you borrow against the equity in your home and receive a lump sum of money that you have to pay back each month within 15 years. Mortgage lenders make it sound like it's free money, but it is not, it is another loan which you have to pay back one way or another. Pulling. no - it doesn't matter what you paid in. If you default, they sell the house. They take the amount they sold it for, and pay themselves the. Many property investment gurus say it's important to repay the loan on your home as soon as you can. The equity that is drawn down from your home to purchase an. As with any mortgage, if the loan is not paid off, the home could be sold to satisfy the remaining debt. You only pay back the amount of money that you borrow, plus interest. For instance, if you have a HELOC with a credit limit of $50, and you borrow $10, Most terms range from five to 20 years, but you can take as long as 30 years to pay back a home equity loan. Once your line of credit becomes available, you start accumulating credit as you pay back the principal on your loan. After 5 months, you'll have paid. Use only what you need when you need it and pay back what you used like you would a credit card. It should be noted that neither a HELOC or. With a home equity loan, you borrow against the equity in your home and receive a lump sum of money that you have to pay back each month within 15 years. Mortgage lenders make it sound like it's free money, but it is not, it is another loan which you have to pay back one way or another. Pulling.

Once that borrowing period ends, you'll continue to pay principal and interest on what you borrowed. You'll typically have 20 years for this repayment stage. If. Your home's equity is the difference between its market value and how much you still owe on your home. So as housing prices rise or you pay off your mortgage. Your home is your castle, but it also can be turned into a liquid asset when you need money. You build equity in your home as you pay your mortgage down, and. This line of credit does not need to be used immediately, and you only pay it back when you start using it. The limits for home equity lines of credit typically. A HELOC has what's called a draw period, usually between five and 10 years, when you can borrow the money and pay it back to borrow again — similar to a credit. A HELOC has what's called a draw period, usually between five and 10 years, when you can borrow the money and pay it back to borrow again — similar to a credit. Paying interest and fees does not count towards paying back the equity loan. If you do not keep up with payments, you may need to pay recovery costs or. Then the lender must cancel its security interest in your home and must also return fees you paid to open the plan. If the required notice and disclosures are. Many property investment gurus say it's important to repay the loan on your home as soon as you can. The equity that is drawn down from your home to purchase an. The one-time loan starts to be paid back immediately through monthly payments at a fixed interest rate. A home equity line of credit extends credit up to a. Homeowners who do have equity in their homes have the option to borrow money against the equity they have built up with a loan or line of credit. In both cases. As with the other products described in this guide, when you die your heirs have to pay back the reverse mortgage loan. Unless they have the money to do so. However, using home equity to pay off debt also has its drawbacks. When you borrow against your home's equity, the home itself serves as collateral. If you. Paying off some or all of your mortgage debt, or any other debt you have on the house, will increase the equity in your home, but that is not the only way for. But you'll have to pay off your existing mortgage and any early repayment charges with the money you release. We recommend checking your residential mortgage's. That means your balance goes up over time, increasing the amount you have to pay, and you have less and less equity in your home. Differences between regular. After that, you'll begin making full interest and principal payments to the lender. Many HELOCs have variable interest rates, meaning your rate can increase. HELOC and home equity loans are considered second mortgages. If homeowners default, these loans only get paid back after the first mortgage is paid. In the. It's important to understand that most home equity lines of credit tend to have variable interest rates, while home equity loans are fixed. Sometimes borrowers. Most lenders will not extend a home equity loan until you have paid off at least % of your mortgage. Usually, you can also borrow only % of the value.